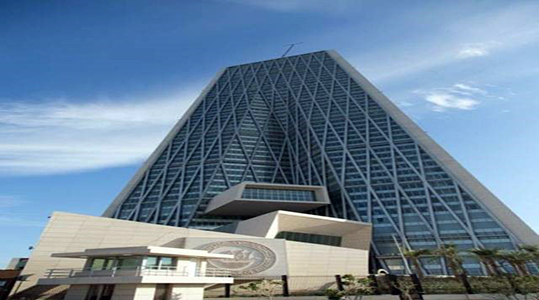

The Governor of the Central Bank of Kuwait, Mohammed Al-Hashel, expected that the Kuwaiti banking sector will remain at the same level of stability, despite the crisis that is afflicting the country's economy due to the Coronavirus, noting that "the double challenge resulting from the repercussions of the pandemic on the economy, and the deterioration of oil prices, led to a sharp decline in the state’s oil revenue.”

On the occasion of the release of the Financial Stability Report for the year 2019, Al-Hashel pointed out that "the strength and durability of the banking sector depends on the duration and severity of the current crisis, and its effects may differ from one bank to another", adding that "thanks to the strong levels of capital adequacy, abundance of liquidity, provisions and asset quality, the sector remained strong and forms a vital part of the mechanism to support the expected economic recovery," considering that "despite the current exceptional circumstances that the Kuwaiti economy is going through, bank credit "may record good positive growth rates."

Standard & Poor's Agency has modified the outlook for Kuwait from stable to negative, stating that the country's main source of liquidity (the General Reserve Fund) will not be sufficient to cover the deficit of the central government, as the balance of the General Reserve Fund is steadily decreasing over the past three years, and this process has accelerated in recent months after the decline in oil prices and Kuwait's implementation of the OPEC+ agreement to reduce oil production.

Source (The New Arab Newspaper, Edited)